starting credit score at 19

Your starting credit score will fall below the median number of 723 even if you pay all of your obligations on time and according to terms during the six. Thats because your credit score doesnt start at zero.

Happy New Year Home Buying Improve Your Credit Score New Years Resolution

Petal 2 Visa Credit Card.

. But no matter where your score stands now using credit responsibly will help to build a credit history improve your credit score and keep it as high as possible. Expect your initial rating to fall to around 670 because you automatically perform poorly on three factors that combine to influence 45 of your number. If you use options such as defermentespecially during COVID-19keep an eye on your credit report.

However the real goal is to get to the 800 range. If you know your credit score search consumer finance. Your credit score doesnt start at zero.

If you are SUPER responsible I would recommend a much higher credit limit and then only use maybe 1015 of. So as long as their limited history is decent theyll tend to fall within this range. The information on those reports isnt always the same.

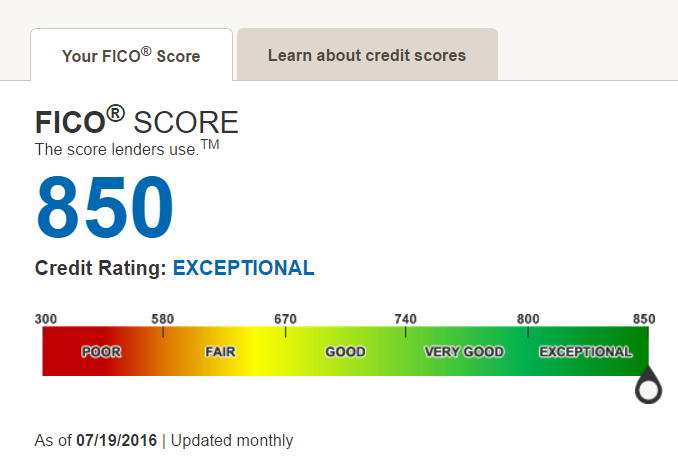

2022s Best Credit Cards for Young Adults. FICO says scores between 580 and 669 are considered fair and those between 740 and 799 are considered very good. In reality everyone starts with no credit score at all.

Moreover 80 of 18- and 19-year-olds don. 688 is a fine score for someone only 19. This is a great strategy to use especially if you are starting out with a fair credit score.

Do you start with 0 credit. Credit score calculated based on FICO Score 8 model. The Federal Trade Commission recommends parents of 16-year-olds to check their childs credit reports.

Not all lenders use Experian credit files and not all lenders use scores impacted by Experian Boost. However the starting credit score isnt zero. Your lender or insurer may use a different FICO Score than FICO Score 8 or another type of credit score.

You should aim to get at least a 670 credit score in order to qualify as good. Your Credit Score Doesnt Start at Zero. As soon as you start using credit cards the numbers in your report will change.

KNOW YOUR CREDIT SCORE. The average credit score for 18-year-olds is 631. Its d none of the above.

Find credit cards geared to individuals in your age range and credit history. Starting with no credit score doesnt mean your score is zero. Heres where it starts getting complex.

Pay off your credit card in full every month before the due date. So you start your credit journey by having no score. Do you begin at a the highest possible credit score b the lowest or c somewhere in between.

To make matters worse the 2009 Credit Card Act imposes extra credit card restrictions for young adults. With a credit score of 800 you get benefits such. This means that your credit score starts at about 300.

October 27 2021 4 min read. Keep your utilization between 1-30. In fact the lowest possible score from FICO or VantageScore is 300.

You have 4300 in savings. The answer may surprise you. Thursday June 9 2022.

Anything above 800 is. What Is A Good Fico Score. Unfortunately its also one of the main reasons those with an invisible credit dont have a score.

Then open a line of credit for 200 or so then spend money on it and pay it off every month. A typical starting credit score range is between 400 and 600 partly because you need some kind of credit file to even have a credit score in the first place. From what goes into your credit score and how to build your credit to tips to keep your great score weve got you covered.

Most people think that their starting credit score would be zero. Thats because your credit score is calculated only at. On my 18th.

Otherwise youll be adding interest to that balance in something like the 19-24 range which is ridiculous given how much savings you have. Results may vary. Starting with no credit score doesnt mean your score is zero.

Besides the length of credit history only determines around 15 of a score. But unless youve had some. For some lenders a credit score below 670 is considered subprime and would either lead to a denied application or the consumer being approved for less favorable terms.

I have one credit card from my bank and paypal credit. Starting credit score at 19 Saturday May 21 2022 Edit. Decided to do my first credit score check and got 702 for Euifax and a 726 for TransUnion.

A good FICO score lies between 670 and 739 according to the companys website. However with some planning and foresight a 19-year-old can still get a credit card and build a score. Some may not see improved scores or approval odds.

Get started by getting a free copy of your credit report. This doesnt require a credit check or independent income. Its d none of the above.

If you dont have income the easiest way to start building credit at 19 is by becoming an authorized user on someone elses account. As you can tell younger consumers on average have lower credit scores while older consumers have higher credit scores. 55 52 votes Without an established history your credit report and credit score dont magically appear when you turn 18 despite many common misconceptions.

However theres no such thing as a starting credit score. However that is simply not true. The first and easiest way to establish credit is to become an authorized user on a persons credit card.

How is my credit score compared to other 19 year olds. Once you have established credit your first credit score could range anywhere from lower than 500 to well in the 700s depending on your initial financial performance. The simplest way may be to add him or her as an authorized user on your credit card today.

Your child does not need to be 18 to start building credit. Rather your score simply doesnt exist. For most young adults this will mean becoming an authorized user on a parents credit card.

The information on these reports is fed into the credit scoring models to determine your credit score. Make sure your lender doesnt. Your starting credit score will fall below the median number of 723 even if you pay all of your obligations on time and according to terms during the six-month evaluation period.

Since credit scores range from 300 850 300 could be considered the starting score. Depending on the scoring model the lowest credit score you can have is 300 not zero. Go to your local credit union open an account.

Do you begin at a the highest possible credit score b the lowest or c somewhere in between. Credit Sesame members in this range saw their credit. Is what eventually produces an excellent credit score.

When you check your credit score for the first time you might be surprised to find a three-digit number even if youve never used credit before.

How Long Can Items Stay On Your Credit Reports Credit Solutions Check Credit Score Credit Repair Business

Is Your Credit Score Affecting Your Chances Of Finding A Partner Good Credit Credit Score Show Me The Money

Pin By Darryl Hunter On Financial Education Services Credit Repair Business Credit Score Credit Education

Understanding What Causes Bad Credit Scores Bad Credit Score Credit Score Infographic Credit Repair

How To Close Credit Cards Without Damaging Your Credit Score Credit Card Pictures Business Credit Cards Credit Card Payoff Plan

Ever Wondered If It Was Possible To Get A Perfect Credit Score Credit Score Personal Finance Budget Personal Finance Lessons

Goals Before Age 30 Life Routines Self Care Activities Business Motivation

26 Million Consumers Credit Invisible 19 Million Unscored Cfpb Credit Score Content Marketing Check Credit Score

Schumer Who Thanks To Nerdwallet For This One Credit Card Infographic Paying Off Credit Cards Credit Card Consolidation

How Can I Start Building My Credit History Improve Credit Score Improve Your Credit Score Credit Score

Angellist S Carta For India Product Helps Startups Manage Cap Table And Employee Grants For Free Apps Asia Startups Angel Investors Start Up Job Seeker

Real Estate Marketing 10 Real Estate Instagram Post Ideas Etsy Real Estate Marketing Real Estate Buying Realtor Social Media

Tips For Beginners On Building Good Credit Society19 Best Credit Card Offers Credit Card Deals Top Credit Card

How To Raise Your Credit Score 100 Points 5 Easy Steps Credit Score Improve Credit Score Improve Credit

Pin By Gul Bedi On Motivstional Quotes In 2022 Paying Off Credit Cards Build Emergency Fund Motivstional Quotes

Fico Score Ranges Credit Score Range Credit Score Good Credit Score

5 Simple Steps To Improve Your Credit Score By 100 Points Improve Your Credit Score Credit Score What Is Credit Score